When the US Federal Reserve and other major central banks embarked upon their quantitative easing programs shortly after the Global Financial Crisis many feared that the impact would be inflationary.

In an open letter to then Federal Reserve Chairman Ben Bernanke, twenty-three of the most recognised economists, investors and analysts outlined their concerns:

“We believe the Federal Reserve’s large-scale asset purchase plan (so-called “quantitative easing”) should be reconsidered and discontinued. We do not believe such a plan is necessary or advisable under current circumstances. The planned asset purchases risk currency debasement and inflation, and we do not think they will achieve the Fed’s objective of promoting employment.

We subscribe to your statement in The Washington Post on November 4 that “the Federal Reserve cannot solve all the economy’s problems on its own.” In this case, we think improvements in tax, spending and regulatory policies must take precedence in a national growth program, not further monetary stimulus.

We disagree with the view that inflation needs to be pushed higher, and worry that another round of asset purchases, with interest rates still near zero over a year into the recovery, will distort financial markets and greatly complicate future Fed efforts to normalize monetary policy.”

At the time the letter was published, the inflation rate was 1.5%. Four years later, in December 2014, inflation had fallen to 0.8%; in early 2015, it had declined further to minus 0.1%.

When the signatories to the forecast were invited to reflect on the content of their letter in light of the subsequent events, one investor, Jim Grant responded by saying, “I think there’s plenty of inflation – not at the check-out, necessarily, but on Wall Street.”

Jim Grant was correct in responding that inflation was there for all to see on Wall Street. He’s even more correct half a decade later – the S&P 500 has increased by two-thirds since late 2014. In contrast, consumer price inflation rebounded to around 2.5% per annum for much of the next four or five years before again returning towards zero during early 2000.

It takes time for money to filter down to the real economy. Banks and other financial institutions are the first beneficiaries and then wealthy investors able to access additional credit facilities. These firms and individuals are in the privileged position in that they can funnel all that extra liquidity into financial assets, often buying at low prices.

An 18th Century Irish-French banker and philosopher called Richard Cantillon noticed an early version of this phenomenon. In the 18th century the closer you were to the King and the wealthy, the more you benefited — from being able to purchase financial assets at low prices and then see those prices inflate. Only later would the effects appear elsewhere, and the further away you were, the more you were harmed — perhaps through higher food prices or lower relative wages.

In An Essay On Economic Theory, Cantillon agreed that an increase of hard money in a state (remember gold and silver were the currencies of choice at the time) will cause a corresponding increase in consumption and this will gradually produce increased prices, but unlike economists before him, he was the first to articulate how it happened.

Related article: The South Sea Bubble: 300 Years Later

Cantillon’s general observation, that money printing has distributional consequences that operate through the price system, is known as the “Cantillon Effect”. Money, in other words, is not neutral. Those who benefit the most from an increase in the supply of money were those with access to credit and assets, or those who supplied products and services to those who did:

“If the increase of hard money comes from gold and silver mines within the state, the owner of these mines, the entrepreneurs, the smelters, refiners, and all the other workers will increase their expenses in proportion to their profits. Their households will consume more meat, wine, or beer than before. They will become accustomed to wearing better clothes, having finer linens, and to having more ornate houses and other desirable goods. Consequently, they will give employment to several artisans who did not have that much work before and who, for the same reason, will increase their expenditures. All this increased expenditures on meat, wine, wool, etc., necessarily reduces the share of the other inhabitants in the state who do not participate at first in the wealth of the mines in question. The bargaining process of the market, with the demand for meat, wine, wool, etc., being stronger than usual, will not fail to increase their prices. These high prices will encourage farmers to employ more land to produce the following year, and these same farmers will profit from the increased prices and will increase their expenditure on their families like the others.”

Meanwhile, those who lost out the most were those on fixed incomes or low wages, far from the money supply:

“Those who will suffer from these higher prices and increased consumption will be, first of all, the property owners, during the term of their leases, then their domestic servants and all the workmen or fixed wage earners who support their families on a salary. They all must diminish their expenditures in proportion to the new consumption, which will compel a large number of them to emigrate and to seek a living elsewhere. The property owners will dismiss many of them, and the rest will demand a wage increase in order to live as before. It is in this manner that a considerable increase of money from mines increases consumption and, by diminishing the number of inhabitants, greater expenditures result by those who remain.”

Eventually, the money printing rots the system from the inside out, acting to reduce the economy’s productive capacity:

“If money continues to be extracted from the mines, the abundance of money will increase all prices to such a point that not only will the property owners raise their rents considerably when the leases expire and resume their old lifestyle, increasing their servants’ wages proportionally, but the artisans and workmen will increase the prices of the articles they produce so high that there will be a considerable gains in buying them from foreigners who make them much cheaper. This will naturally encourage several people to import products at lower prices from foreign factories, and this will gradually ruin the artisans and manufacturers of the state who will be unable to sustain themselves by working at such low rates because of the high cost of living.“

Far from a temporary phenomenon, the surge in the money supply has lasting consequences:

“When the overabundance of money from the mines has diminished the number of inhabitants in a state, accustomed those who remain to excessive expenditures, raised the prices of farm products and the wages for labor to high levels, and ruined the manufactures of the state by the purchase of foreign products by property owners and mine workers, the money produced by the mines will necessarily go abroad to pay for the imports. This will gradually impoverish the state and make it, in a way, dependent on foreigners to whom it is obliged to send money every year as it is extracted from the mines. The great circulation of money, which was widespread in the beginning, ceases; poverty and misery follow and the exploitation of the mines appears to be only advantageous to those employed in them and to the foreigners who profit thereby.”

Returning to the letter to Bernanke shortly after the GFC, Cantillon would have argued that all that extra money would show up in higher prices eventually, but that it wouldn’t necessarily be the price at the shop where you see the evidence, or that it would be proportional to the rise in supply. It all depends on who gets the money first, and what they want to purchase:

I conclude from all this that by doubling the quantity of money in a state, the prices of products and merchandise are not always doubled. The river, which runs and winds about in its bed, will not flow with double the speed when the amount of water is doubled.

The change in relative prices, introduced by the increased quantity of money in the state, will depend on how this money is directed at consumption and circulation. No matter who obtains the new money, it will naturally increase consumption. However, this consumption will be greater or less, according to circumstances. It will more or less be directed to certain kinds of commodities or merchandise, according to the judgment of those who acquire the money

Rather than noble barons being the chief beneficiaries of new gold supplies, today those closest to the seat of monetary power are the banks, hedge funds, and other wealthy investors. As before though, this means those closest to the power can purchase assets on the cheap before the general population. As before the general population come off worse, either by having to purchase overpriced assets or in seeing their currency debased, or indeed both.

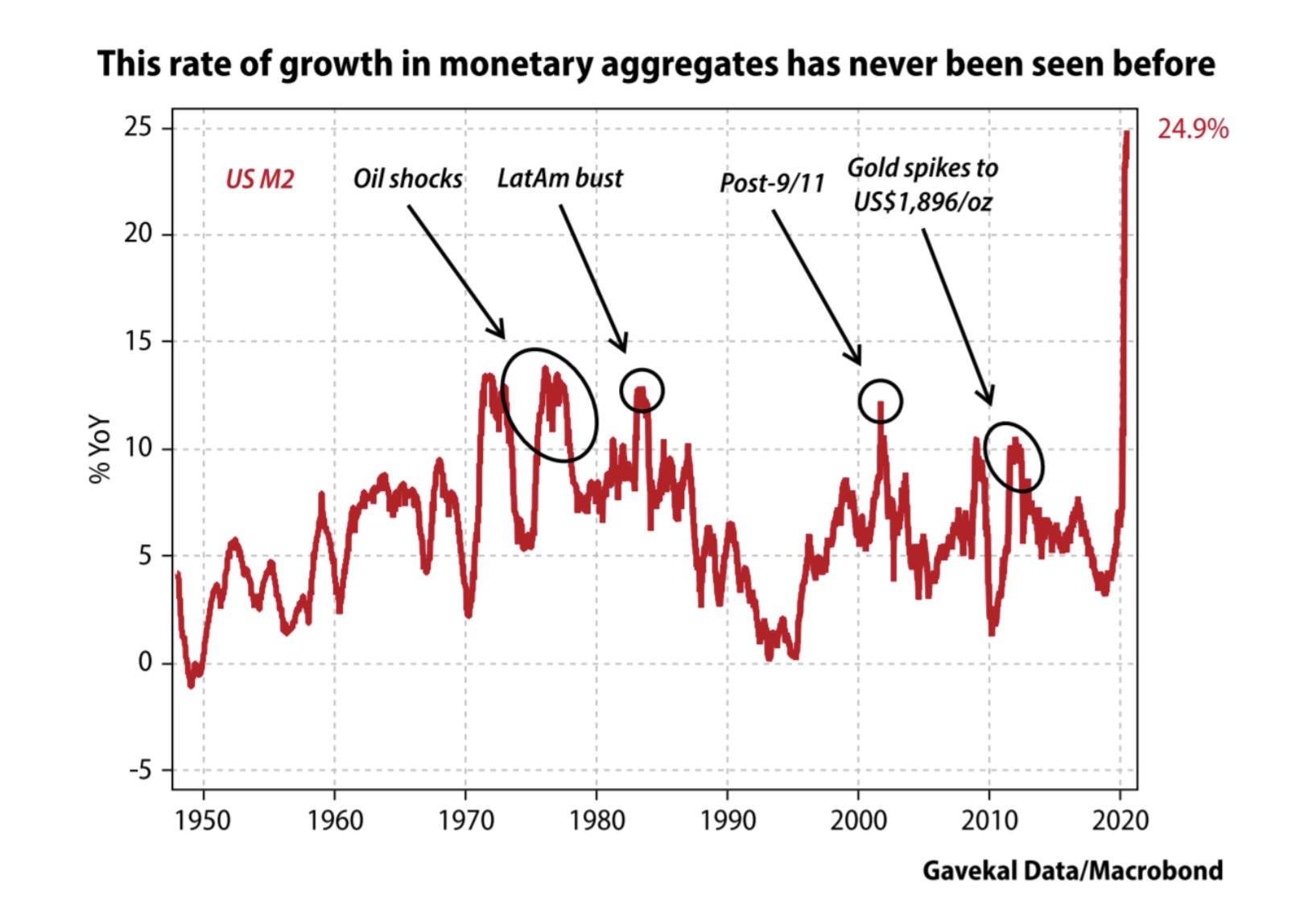

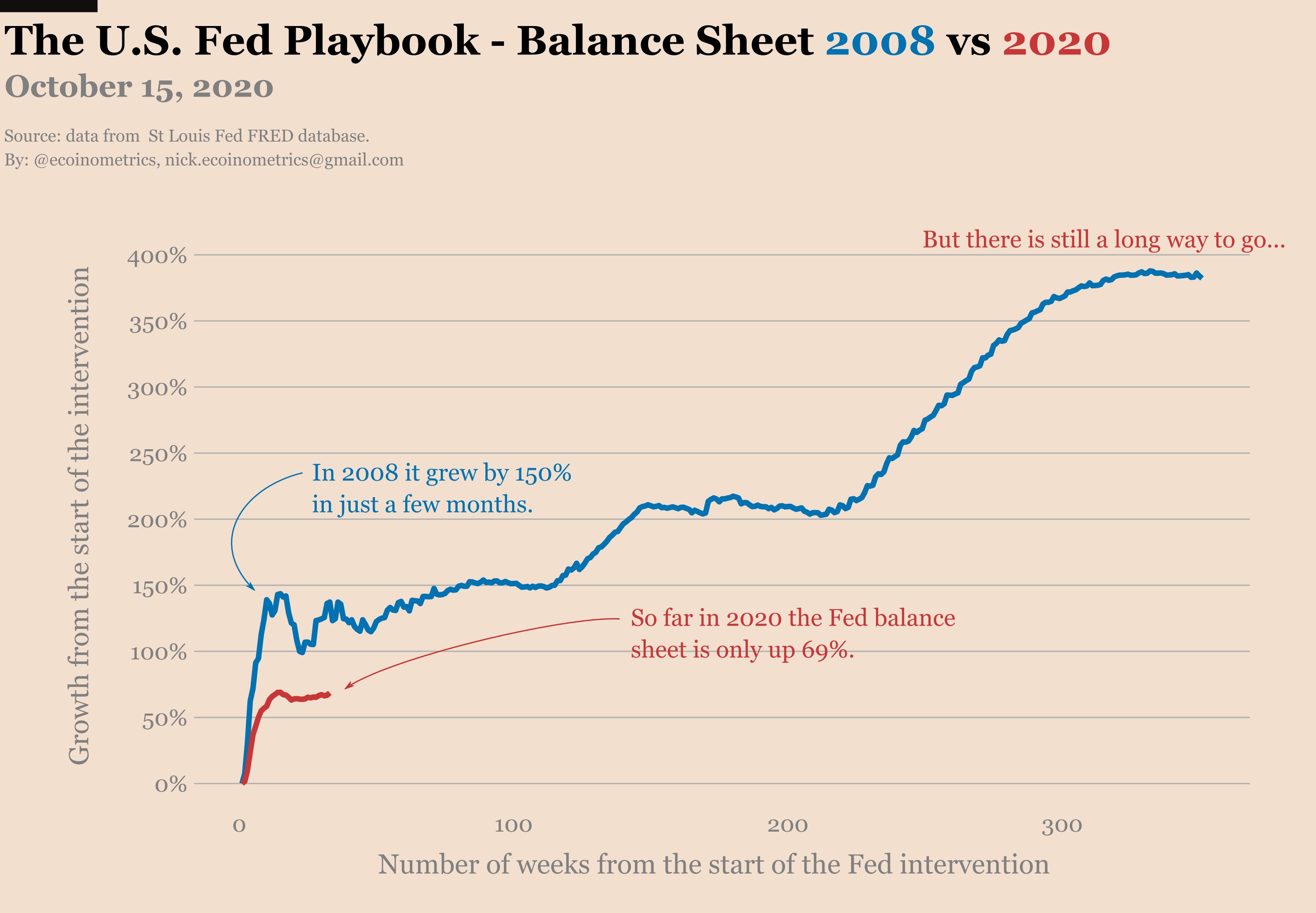

Returning to the present day the scale of the expansion in the money supply is unprecedented. The Federal Reserve has added almost $3 trillion to its balance sheet, dwarfing the central banks action over a decade ago. The result has been a 25% growth in US money supply.

And yet there’s reason to suggest it’s only just getting started:

Things can happen so quickly yet are only visible in the fullness of time, and safe in the knowledge that you know what you’re looking for. While stock markets (particularly tech stocks) have benefited from central bank largess, gold and other hard stores of value (for example, Bitcoin) have gained even more.

One of my favourite economics quotes is that of Rudiger Dornbusch, “In economics things take longer to happen than you think they will, and then they happen faster than you thought they could.”

Better to front run the crowd than be left behind.

Related article: The gold stock-to-flow model