Could nickel prices have fallen too far? Nickel prices jumped 6% today to around $15,600 per tonne on fears that the coming depletion of China’s nickel ore stocks, cuts to China’s nickel pig iron (NPI) production and the Philippine monsoon season may all boost prices.

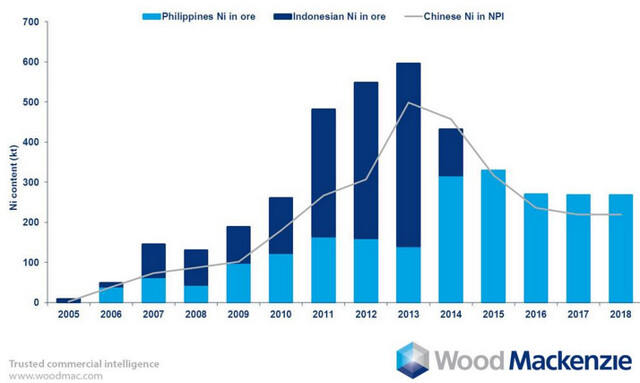

To recap after Indonesia introduced an export ban on nickel ore in mid-January, nickel prices promptly surged by over 50% reaching a high of just over £21,000 per tonne in mid-May. Prices were also buoyed by geopolitical concerns elsewhere, namely the risk of sanctions on the worlds biggest nickel producer, the Russian company Norilsk Nickel.

Unlock commodity market insight now and subscribe to our email updates or

A jump in nickel output from the Philippines, concerns over weak demand and high stock levels resulted in prices almost erasing the price jump.

Monsoon rains in the Philippines may disrupt nickel mining and exports to China over the next four months. Most producers in the Philippines’ main nickel mining region of Caraga are expected to close operations as normal from October or November until early next year. The country’s Mines and Geosciences Bureau (MGB) said that there are at least a dozen nickel mines in Caraga, 10 of them produced zero during the first quarter of 2014.

Related article: What happened to the nickel price boom?

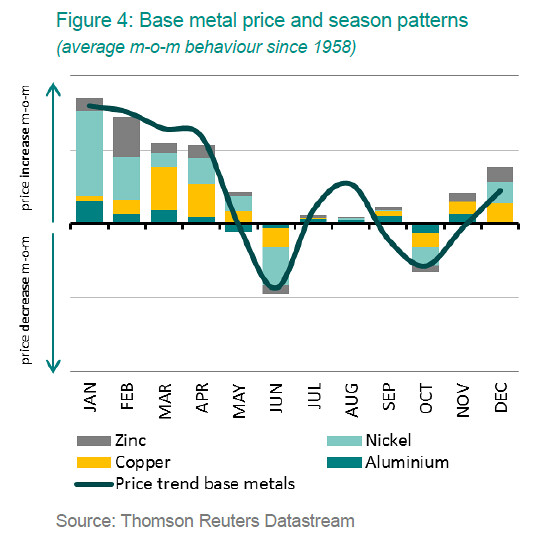

Sharp price increases in nickel prices are nothing unusual between December and April. Since 1958 nickel prices have increased by an average 6% month on month in January alone.

Meanwhile, according to Goldman Sachs about 70,000 tons a year of China’s NPI capacity may be shut in order to reduce pollution in the lead up to the APEC meeting in Beijing that starts on 10th November. Cuts in NPI, which represents 25% of global refined nickel supply are also expected to occur due to current low prices.

The monsoon and cuts to China’s NPI output may speed up the depletion of China’s nickel stocks. There were suggestions at the start of the year that Chinese consumers had front-run the potential ban by stockpiling substantial amounts of nickel ore to see out any supply outage for at least 6-9 months. Chinese producers were then seen blending Indonesian and lower grade Philippine ore in order to extend nickel production. According to Shanghai Metals Market China is expected to use up its nickel ore inventories by April 2015.