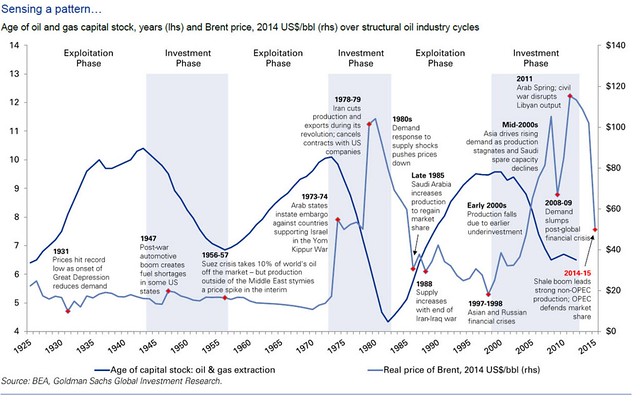

The following three charts courtesy of Goldman Sachs (h/t @ZeroHedge) show how knowing what stage we are in a cycle, cycles that have repeated themselves over and over again can tell us about where prices may go next. The final chart shows why its important to also look behind the price.

While the current investment phase may be coming to an end that doesn’t mean that supply will slow supporting prices, at least not yet. In the last cycle it was ten years before prices finally bottomed in the late 1990’s.

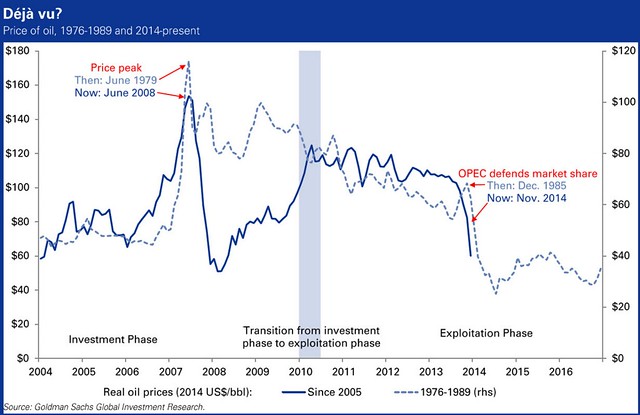

Price patterns certainly do repeat themselves…

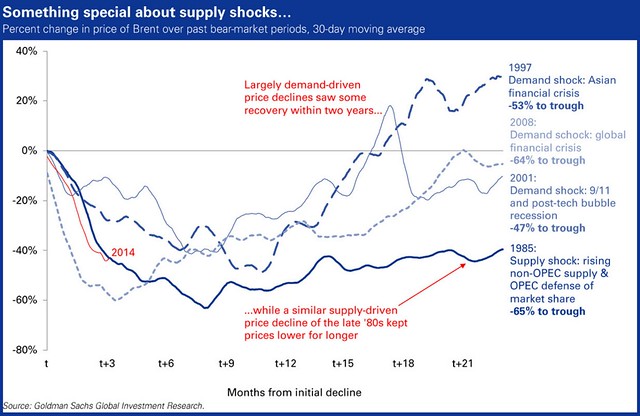

…but more importantly its the reason behind the price that makes the difference. Never start an argument with the price is good advice. Sharp price falls caused by supply shocks tend to linger, much longer than one caused by demand shocks.