Gold prices hit record levels this week. That much is old news now. What has escaped the front pages is that another commodity is also nearing record levels. That commodity is lumber.

Record price levels often represent a critical juncture. Either markets push through the resistance and power on, or it all becomes too much and gravity reasserts itself in a spectacular way.

Nevertheless, the relationship between the two commodities offers has offered important insights into the potential return on risk assets. It might pay to watch how each of the commodities plays out over the next couple months.

But first why is lumber important? When we are confident about the future of the economy we are more comfortable making big expensive decisions that are difficult or impossible to reverse. Think of buying a house or a second house even or starting a family!

House purchase activity is an important signal as to the health of the economy – both local and national. It’s not just the cost of the house but spending on all the other things involved with a house; renovation, construction and utilities etc. Together housing represents around one-sixth of the US economy.

A house is by far the largest single purchase that most people will ever make and so it’s an important signal of consumer confidence. Who wants to buy a house when they are worried about where their next pay cheque will come from?

Housing starts are a terrific leading indicator of the US economy. It can take several months for home builders to construct a new property and home builders are reluctant to break ground on new projects if they fear the economy may slump later in the year. Every recession in the US since 1960 has been preceded by decline in housing starts of on average around 25%.

Could there be an even better, even longer leading indicator? Well, the price of lumber is often seen as a leading indicator of the US housing market. Construction companies need to purchase materials to build new houses and the cost of the lumber is a key factor influencing the overall build cost.

If you start to see lumber prices decline sharply and for a prolonged period it typically means that a slowdown in housing starts is around twelve months away. However, as with all market based indicators supply as well as demand influences the price.

Many of you will know that copper and the cost of shipping dry freight are frequently cited as leading indicators of economic activity and demand for commodities. But another indicator that doesn’t get anywhere near as much coverage is the price of lumber in the US, and its relationship with the price of gold.

Research published by Michael Gayed and Charlie Bilello looked at the relationship between lumber and gold prices between 1986 and 2015. According to the research combining cyclical lumber with non-cyclical gold provides key information on when to “play offense” and when to “play defense” in an investment portfolio. Using weekly data available on lumber and gold prices going back to November 1986, the pair developed the following trading rule:

> If lumber is outperforming gold over the prior 13 weeks, take a more aggressive stance in the portfolio for the following week.

> If gold is outperforming lumber over the prior 13 weeks, take a more defensive stance in the portfolio for the following week.

> Re-evaluate weekly and make changes to the portfolio only when leadership between lumber and gold changes.

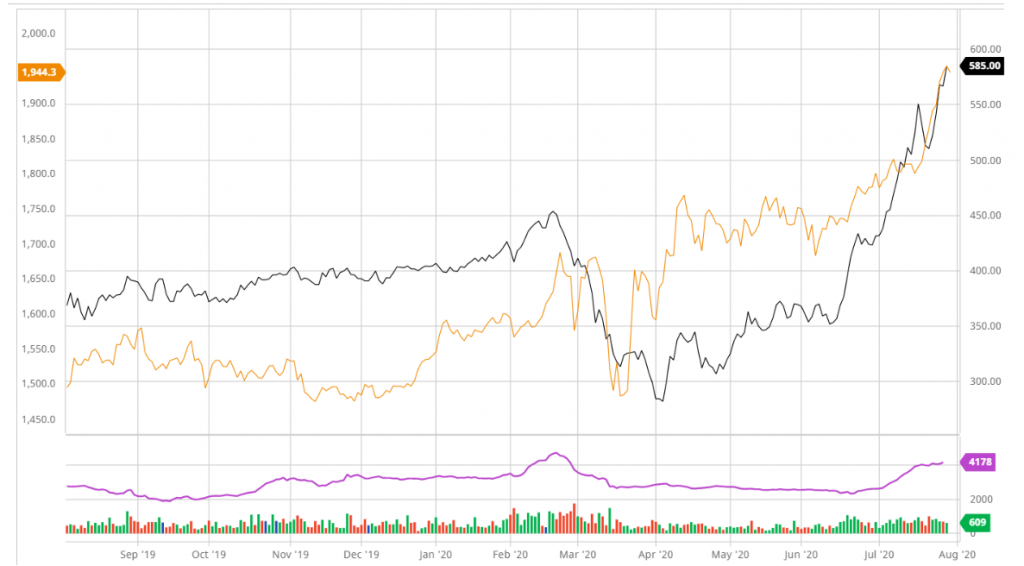

From late 2019 and through the first two months of 2020 the price of gold rose at a slightly faster rate than lumber prices. Equity and other markets including commodities fell sharply thereafter as the scale of the impact from covid-19 became clearer. The past two months have seen the roles dramatically reversed with lumber prices up 60% compared with an 11% rise for gold.

Chart: gold versus lumber prices

Gayed and Bilello’s model implies that this means investors should be more aggressive with their portfolio’s, i.e. greater weighting to equities and more small-cap socks for example.

Lumber like many commodity markets has not gone unscathed from the covid-19 pandemic. Many lumber mills were forced to close, or at least severely limit their output during April and May due to social distancing restrictions.

That being said the lumber-gold ratio has been an important bellwether for risk assets in the past despite historical supply disruptions. As both commodities hover near record highs the next couple months are likely to offer an important signal as to the future direction for equity markets.

Related article: The Baltic Dry Index is a lousy predictor of commodity prices

Related article: The predictive power of the copper-gold ratio